Arctic MSCA-PF Program

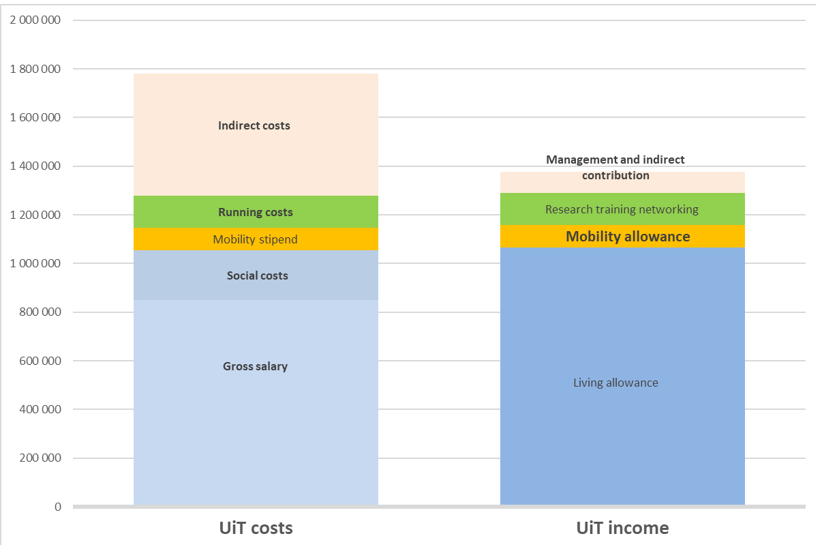

Marie Skłodowska-Curie - Postdoctoral Fellowships at UiTThe MSCA-PF budget is based on unit costs, cf. table below. EU regulations define how these unit costs are to be used in the project and there is limited flexibility to reallocate allowances to other cost items. In practical terms, e.g. remuneration of the MSCA fellow, the picture is more complicated as national taxes for both the employee, and the employer has to be taken into account. Furthermore, the Euro to NOK currency conversion rate will affect the overall budget.

MSCA-PF budget and unit costs for 2026

*Living allowance is muliplied with a country correction factor 1.286 for Norway. Long-term leave allowance and special needs allowance are in most projects not relevant.

| MSCA Postdoctoral Fellowships | Contributions for the recruited researcher per person-month | Institutional unit contributions per person-month | |||||

| Living allowance* | Mobility allowance | Family allowance | *Long-term leave allowance | *Special needs allowance | Research, training and networking contribution | Management and indirect contribution | |

| 6350 | 710 | 660 | N/A | N/A | 1000 | 650 | |

Contributions for the for the recruited researcher

Living Allowance

According to EU regulations, the beneficiary (UIT) must pay to the postdoctoral researcher at least the amount of the living allowance minus all compulsory deductions under national legislation. At UiT, the living allowance is converted into the fellow’s gross salary and mandatory deductions, including holiday pay, pension, insurance and employer tax are covered by the living allowance.

UiT policy is to employ MSCA postdoctoral fellows with a similar salary as other UiT employees in the same positions within the faculties and/or disciplines. Candidates will most often be employed in a researcher position.

If the living allowance received from EU is higher than UiT total salary costs (including taxes), the MSCA postdoctoral fellows may receive periodical payment to compensate the difference. Faculties/departments will use a conservative exchange rate and at the latest pay balance at end of the project to ensure rate compliance.

Mobility allowance

Recruited researchers should also receive the mobility allowance. At UiT, this is paid as a stipend in addition to the salary. The stipend is also taxed according to Norwegian legislation.

Family allowance

If the recruited researcher is eligible for family allowance, this unit cost will also be paid to the candidate. This allowance is also taxed according to national legislation.

Family is defined as persons linked to the researcher by (i) marriage, or (ii) a relationship with equivalent status to marriage recognised by the legislation of the country where this relationship was formalised, or (iii) dependent children who are actually being maintained by the researcher.

If the researcher acquires family obligations during the action duration, the family allowance must be paid to him/her as well.

Institutional costs

Research, training & networking costs cover the costs of the RTN activities in the project. It includes costs for e.g. travel and subsistence costs for participation in conferences, field work costs, consumables, analysis and other running costs for carrying out research and training activities. A maximum of 24.000 Euro is available for European Fellowships, and if additional funding is needed, it has to come from other sources.

Costs related to secondments should generally be covered by this item, including if the hosting institution requires any bench fees, tuition, or costs related to office space.

The unit cost for management and indirect costs is to be considered as overheads.

Transfer between categories

Parts of Institutional costs can be transferred to Costs for the recruited researchers, but it is not likely with the current funding rates provided by the EU. The use of institutional costs is decided by the beneficiary.